Electric Victory Gardens

1/26/23 – How to make the electrification incentives of the Inflation Reduction Act work for you

Hello everyone:

This week’s post is most relevant to my American audience. For the 18% of you who reside in other nations, my apologies. If you’re new to the Field Guide and if for some reason you’re not enthralled with U.S. federal incentives for energy efficiency… then perhaps you’ll accept my invitation to explore the archives. (For a specific recommendation, try The Road to No Cassandras, from a year ago.) You can expect a more typical Field Guide essay next week.

As always, though, please remember to scroll past the end of the essay to read some curated Anthropocene news.

Now on to this week’s writing:

The history of the Anthropocene is, in part, a history of failed policy. It is also a record of willful blindness, economic irrationality, corporate selfishness, ecological amnesia, and the desire by wealthy nations to enslave poorer nations and the living world for astonishingly small-minded reasons, but those are topics for another day. I want to focus on policy because of one very bright light amid the general darkness that has emanated out of D.C. in the decades since it was painfully obvious to the scientific community that greenhouse gas emissions were an existential threat.

The Inflation Reduction Act, despite the name, has very little to do with inflation. It is instead a large surviving fragment of an incredibly ambitious attempt by American progressives to make a better world. The IRA reduces the cost of healthcare and prescription drugs, more appropriately taxes large corporations, and funds the IRS and closes a tax loophole in order to better tax the wealthy. On the climate change front, it a) invests heavily in domestic production and research for renewable energy and infrastructure and b) incentivizes Americans to live and drive in more climate-friendly ways. (Read here for a thorough breakdown of the IRA’s expenditures.)

That final point about incentives is my topic today, and rather than writing an essay I’m laying out the basics about these incentives and how you can take advantage of them. There is, or will be, $394 billion available for combating climate change, though most of it is for industry to motivate private investment in clean energy, transport, and manufacturing. This still leaves $4.5 billion in rebates and $43 billion in tax incentives for you and me as homeowners, renters, and car buyers. These incentives should jumpstart the American push for a cleaner economy.

The U.S. is responsible for about 25% of greenhouse gas emissions since 1800, despite (currently) having only 4.25% of the global population. We have a lot of catching up to do.

Before jumping in, though, I should pause to note a reality larger than politics and policy. Everything on the table here is borne from tech-optimism, which broadly speaking is what got us into this mess in the first place. A Better, More Prosperous World has been achieved only for some people in some places, and at the extraordinary cost of devastated ecosystems, an accelerated extinction rate, acidifying oceans, and an increasingly unstable climate.

Whether incentivizing consumers to make better choices can reduce the mess in a meaningful way remains to be seen, but it’s worth saying that subsidizing consumption on a planet that’s being over-consumed seems a bit counterintuitive. It’s become painfully obvious that fundamental changes to reduce our consumption and its impacts are required.

We cannot merely electrify the status quo.

Still, there is a solid sustainable logic here: we desperately need to be living efficient human lives powered by renewable energy. We need to decouple growth, prosperity, and other markers of better human lives from existential harm to the ecology of this planet. Our quest for abundance must include abundance for the rest of life on Earth too.

So, with that cheerful note behind us, let’s go shopping.

By far the best source online is Rewiring America, a nonprofit dedicated solely to the “electrification of everything” as a path forward toward a more sustainable U.S. economy. I’ve been impressed with how well they sell the importance of what they do. Here’s part of their pitch for motivating you and me to take advantage of the rebates and tax breaks created by the IRA:

Think of the IRA as a free electric bank account with your name on it, because that’s what it is. It’s your own personal fund to help you go electric — swapping out your old, fossil-fueled appliances for new, clean electric ones — over the next ten years.

And here’s another part of the pitch:

By utilizing the IRA's incentives, Americans will bring billions of dollars in benefits to their communities, saving money at the household level, creating local jobs and fighting the climate crisis with every heat pump installed. Since 42 percent of energy-related emissions come from the machines we rely on daily, our mandate is clear: within ten years, every new machine installed must be electric.

I like also their comparison of electrification to the Victory Gardens of WWI and WWII, when a nationwide community effort to grow our own food led to increased self-sufficiency, direct support for a global battle, and a sense of purpose during crisis. In these times, we all need to participate in order to win.

I recommend you download Rewiring America’s clear and comprehensive 34-page guide to the IRA here. Elsewhere on their site you can find some optimistic, well-summarized set of economic estimates. Some of these include:

All 121 million U.S. households can take advantage of this “bank account”

Households which take advantage will save, on average, $1,800 on energy expenses

80 million homes can receive an average of $10,600 in incentives

Incentives and savings will be particularly important for low- and moderate-income households, which spend three times as much of their income on home energy

“If we hit our climate targets, the IRA will deliver $858 billion in support for residential electrification to our communities, unlocking more than one trillion dollars of cumulative economic benefits.”

That said, I’m not a big fan of large-scale, long-term economic predictions. I’ve seen too many enthusiastic but half-witted estimates of job creation, for example, to put much stock in economists. I’ll confess to a bias against economists, though, since they’re a tribe constantly bowing at the altar of that most false and destructive of modern gods: constant growth.

So let’s get specific. What’s the likely size of your new bank account? How will the IRA’s incentives help you live a better, cleaner life at home? (I don’t have space this week to discuss the complicated incentive offerings for electric vehicles (EVs), but there are major opportunities there and I recommend you read this excellent NPR article explaining them.)

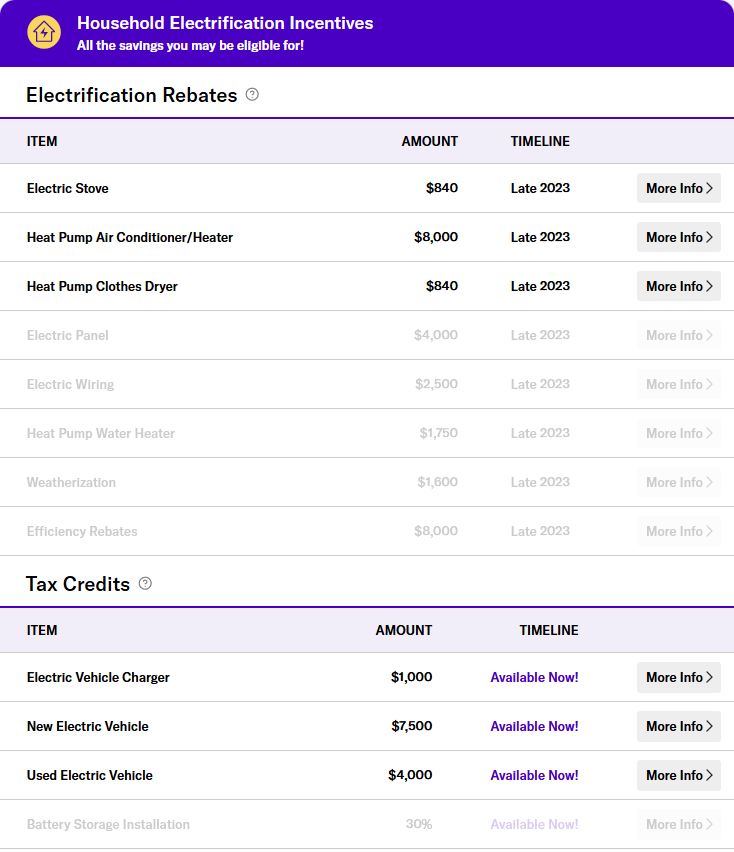

To find out, focus your time and efforts on Rewiring America’s IRA Calculator. It’s simple: plug in your zip code, your gross income, whether you rent or own, your tax filing status (Single, Joint, or Head of Household), and the size of your household, and then hit Calculate. Here’s a sample, based on a hypothetical home-owning family of four in Portland, ME, with a $85,000 household income. The first image shows the Calculator, the second shows the available rebates, and the third shows the available tax credits:

There’s a lot to unpack here. First, marvel at the $20,450 available to this family. It could be you! Second, understand that there is an income-based framework for these benefits, particularly for the rebates. As long as your household's income is less than 150% of the area median income (AMI), adjusted for household size, you’re eligible for rebates up to a total of $14,000.

Below 80% of the AMI, 100% of expenses will be paid (up to the 14K limit). If your income is between 80% and 150% of the AMI, 50% of expenses will be paid (but also up to 14K). This wise and kind legislation, folded into the IRA, is known as the High-Efficiency Electric Home Rebate Act (HEEHRA), which will “provide point-of-sale consumer rebates to enable low- and moderate-income US households to electrify their homes.” This is free money, paid upfront by the government to whoever is installing your heat pump, heat pump water heater, heat pump clothes dryer, stove, electrical panel, and wiring, or making your house more weather-tight. If your income is low enough, and your home isn’t large, you may well be able to install these appliances and upgrades for free, and you won’t have to deal with it on your taxes.

If your income is too high for rebates, you still have tax credits to use. I changed the income in the example above to $300,000 and still found over $15,000 in available tax credits. This is a reminder that however much these incentives favor low- and moderate-income households, the Biden administration’s larger goal is to move all income brackets toward energy-efficient economic choices.

You’ll note that for some items – a heat pump water heater, for example – there are both rebates and tax credits available. These can be stacked. In the example above, there’s $1,750 in rebates and up to $2,000 in tax credits for a water heater. Together these may well cover the entire cost of purchase and installation. Even better, there’s a good chance that some of these benefits can also be stacked with existing state incentives, but that will be a state-by-state decision.

I should remind you of one important caveat: The systems being replaced must be fossil-fueled. A home with electric resistance heating source may not qualify for replacement with a heat pump heating system, and a home with an electric stove (either resistance or induction) won’t qualify for a new one. These are the only two exceptions, I believe. An electric water heater can be replaced with these incentives, for example.

The tax credits are a bit more complicated than the rebates. (Remember that I’m setting aside the EV (electric vehicle) offers because I don’t have room to discuss them here.) The non-EV big-ticket items – rooftop solar, battery storage, and geothermal – are being discounted by 30% with tax credits. There’s no cap on these expenses, so whether you install a small or large rooftop solar system you’ll save a third of the cost through your taxes. Many of us can’t afford that big upfront expense, plus the battery storage, but the IRA puts it within reach for a lot more homeowners.

Tax credits for the other items – heat pumps, water heaters, electrical panels, weatherization – are not merely one-time credits. These are per-year tax credits, which means that you might want to spread out these installations to maximize their tax benefits. That will depend on your specific circumstances.

What about renters? There are 40.7 million renters living in 34.6% of America’s occupied housing units. Heather and I are two of them, enjoying a lovely older house here in coastal Maine. What’s in the IRA for the likes of us? A good amount, as it turns out.

If I change my hypothetical family of four into renters, there’s still $16,150 in rebates and credits available, though two thirds of that money is for a new or used EV and a charging station. Long-term renters in a house could choose to invest in the building, or they could only invest in portable appliances like window-unit heat pumps, a heat pump clothes dryer, and an electric/induction stove, all of which they can bring to their next home (along with the savings on their energy bill).

Renters in apartments can also bring these portable efficient units with them, and they might also benefit if their landlord takes advantage of the IRA’s incentives for affordable housing energy upgrades and tax credits for efficiency upgrades in commercial buildings (including apartment buildings). Rewiring America has a hypothetical example of a retired couple on a $30,000 income, which is below 80% of AMI, and illustrates how they might benefit from the IRA:

Whether you’re an owner or renter, you’ll want more details on each rebate and tax credit. There’s far too much for me to include here, so start by clicking on the “More Info” button next to each item in the Calculator results. Rewiring America explains the financial and environmental value of each efficient upgrade, and provides information on how the rebates and tax breaks work. I also recommend that you dig into the benefits of heat pumps if you haven’t already. They’re cost-effective, super-efficient, and often an excellent replacement for both your heating and AC systems. Check out Rewiring America’s lengthy discussion of their emissions benefits.

Let’s talk about timing. As you can see in the Calculator results, the tax credits are mostly available now, while the rebates won’t become available until late this year or sometime in 2024, once the federal roll-out begins and your state agencies have plans in place to manage the process. This will be no small feat, because states will have to create a multifaceted but streamlined process that contractors will be willing and able to use.

Even if you expect to use the rebates, you should start planning now, particularly if you have an older house that may need a lot of upgrades. You might want to start with an energy audit, for which there’s a partial tax credit. The audit will determine what kind of weatherization should be done (more rebates and credits!), how best to upgrade or supplement your heating/cooling system (heat pumps are amazing at both!), and whether your home’s wiring and electrical panel need replacing (more free money!). From this assessment you can map out what you need, what you can afford, and what you’ll want to do first. Remember that the tax credits are available now.

For work that relies on rebates, a year away, you may still want to talk to a contractor this year. Around here, contractors are already so busy they often don’t return phone calls. The U.S. is desperately low on electricians, plumbers, heat pump installers, etc., and once Americans really catch on to these IRA benefits the supply and demand problem may become much worse. There is some money in the IRA for training programs, but not enough.

If you know someone who’s looking for a few decades of well-paid, steady work…

The good news is that the IRA’s benefits will be available until 2032, so you have plenty of time. Still, though, there’s a lot of money to be saved on energy costs every year once you’ve done the work, so sooner is better.

Finally, even if you can take advantage of most or all of these benefits, you’ll probably want to spread them out over at least a couple years in order to better use all the tax credits.

I’ve barely scratched the surface of this topic, but hopefully I’ve piqued your interest. Spread the word, especially to folks you think might benefit the most. For a deeper dive, you can explore the entire Rewiring America website, or go straight to the IRA source material (here’s a 28-page pdf with all the relevant sections of the IRA), to summaries from the White House or Dept. of Energy, or to good articles from American Progress, the Times, and the Conversation.

If nothing else, plug your info into the IRA Calculator at Rewiring America, and see what the future might hold.

Again, there is no bright future in which we merely electrify our way out of the mess we’ve made of life on Earth. But it’s one of many big steps that has to happen. There are downsides for biodiversity in all the manufacturing necessary to transform civilization’s infrastructure, I know, but the bull’s attempted exit from the china shop is always going to resemble its entrance.

On a personal level, it’s quite possible the IRA could change lives in substantial ways. You could get a weather-tight home, an induction stove and heat pump water heater, and a heat pump heating/cooling system for the entire house, all for free or close to it. Once installed, they may save you hundreds or thousands of dollars, year after year. You might be better able to afford the expense of rooftop solar or an EV. Someone you know might even get a well-paid job as an installer.

Whatever combination of physical and financial benefits you receive from this new enlightened federal policy, though, there is the other, more existential pleasure to be gained from knowing that the infrastructure of your life rests a bit more lightly on the Earth. If our energy consumption and our energy sources are healthier, then our lives will be too. It will take some patience and planning and effort to make this all happen, but it’s worth it to get rid of what my fellow Substack writer Kathleen Sullivan eloquently called the “oil furnaces burning in the dank basements of our lives: hidden springs of heat, hidden sources of destruction.”

In short, it seems like a Victory Garden worth planning and planting.

Thanks for sticking with me.

In other Anthropocene news:

First, two bits of related good news: From Yale e360, heat pumps are quickly becoming popular in Europe, and from Inside Climate News, the rapid growth of renewables in the U.S. has already led to clean energy feeding a full quarter of the grid.

From Aeon, an excellent article by two experts explaining in clear and convincing language why there is simply no chance of humans moving to some other planet, especially as some kind of escape from a doomed Earth. We think we’re adaptable, but we somehow forget that we need exactly what this planet has provided to us all along.

Want to support wildlife conservation and give a gift of fine art at the same time? Please check out Vital Impacts, where you can shop for incredible images of wildlife and the natural world from some of the world’s best photographers, each of whom has provided their images to Vital Impacts because they want their work to support an Earth in crisis. You’ll need a fair amount of disposable income, but if you have it this is one good place to spend it.

From Anthropocene, an excellent pragmatic comparison of the virtues of both fission and fusion nuclear power as we look for large-scale long-term solutions.

From the Guardian, an investigation reveals what many of us already suspected, that the rainforest carbon offsets so many large corporations rely on for their sustainable credentials are actually worthless, or worse.

Good news from the Times: the largest temperate rainforest in North America is now protected again by the Forest Service’s “roadless rule.” Tongass National Forest in southeast Alaska had these protections until 2020, when the Trump administration stripped them away. Stay tuned to see what happens with the next administration…

Hi everyone: I've fixed/updated a bad link to the 2-page pdf summary of the IRA's economic benefits from Rewiring America. A better source for that info is here: https://map.rewiringamerica.org/. For a clear and comprehensive guide to the IRA, you can download Rewiring America's 34-page document on their site here: https://www.rewiringamerica.org/IRAguide. My apologies for the mix-up.

Simply outstanding reportage and writing, Jason!